Introduction to Special Situation Investing

Welcome Investors !

In today’s issue I’ll explain Special Situation Investing. Why they are profitable and how to profit from them? So without further delay ,let’s dive straight in.

What is Special Situation ?

Special Situation are unusual corporate events that leads to mispricing of shares. It could occur in any form say stock buyback,tender offer,merger,bankruptcy, CEO resignation,strike,right issue,spin off and many more. (Don’t worry I’ll explain each topic)

*Stock Buyback - when a company purchase its own share from open market .

*Tender Offer - Tender offer is invitation to existing shareholder to sell their shares for specific price within particular time.

*Merger - when two companies agrees to unite and create single entity.

*Right Issue - Right issue is invitation to existing shareholders to buy additional shares in the company at discounted price.

*Spin off - when a parent company splits itself into two separate companies.

What are the sources to know about the Special Situation Opportunities?

You can stay yourself updated about these opportunities through company announcements, news releases,Investor presentation and Company notice .

DO YOU KNOW - Greatest Investor of all time Warren Buffett is one of the special situation investor .

If you want to know more read late 1950s and 1960s Buffett’s letters.

How can I Invest in Special Situations ?

You can invest directly in such companies or you can opt mutual fund routes like Aditya Birla SL Special Situations Fund,special situation fund by Negen capital,Axis special situation fund etc.

Are these Special Situation Profitable ?

Yes ! Special situations are profitable because very few market participants are aware about such opportunities and generally no one wants to buy companies that are suffering from temporary issue such as debt problem or bankruptcy.

If you want to learn more about Special Situation Investing you can read following :-

You can be stock market genius by Joel Greenblatt

Special situation investing by Brian J. Stark

The New Contrarian Investment Strategy by David Dreman

Investor’s Guide to Special Situation in Stock Market by Maurece Schiller

*UPCOMING SPECIAL SITUATION OPPORTUNITIES*

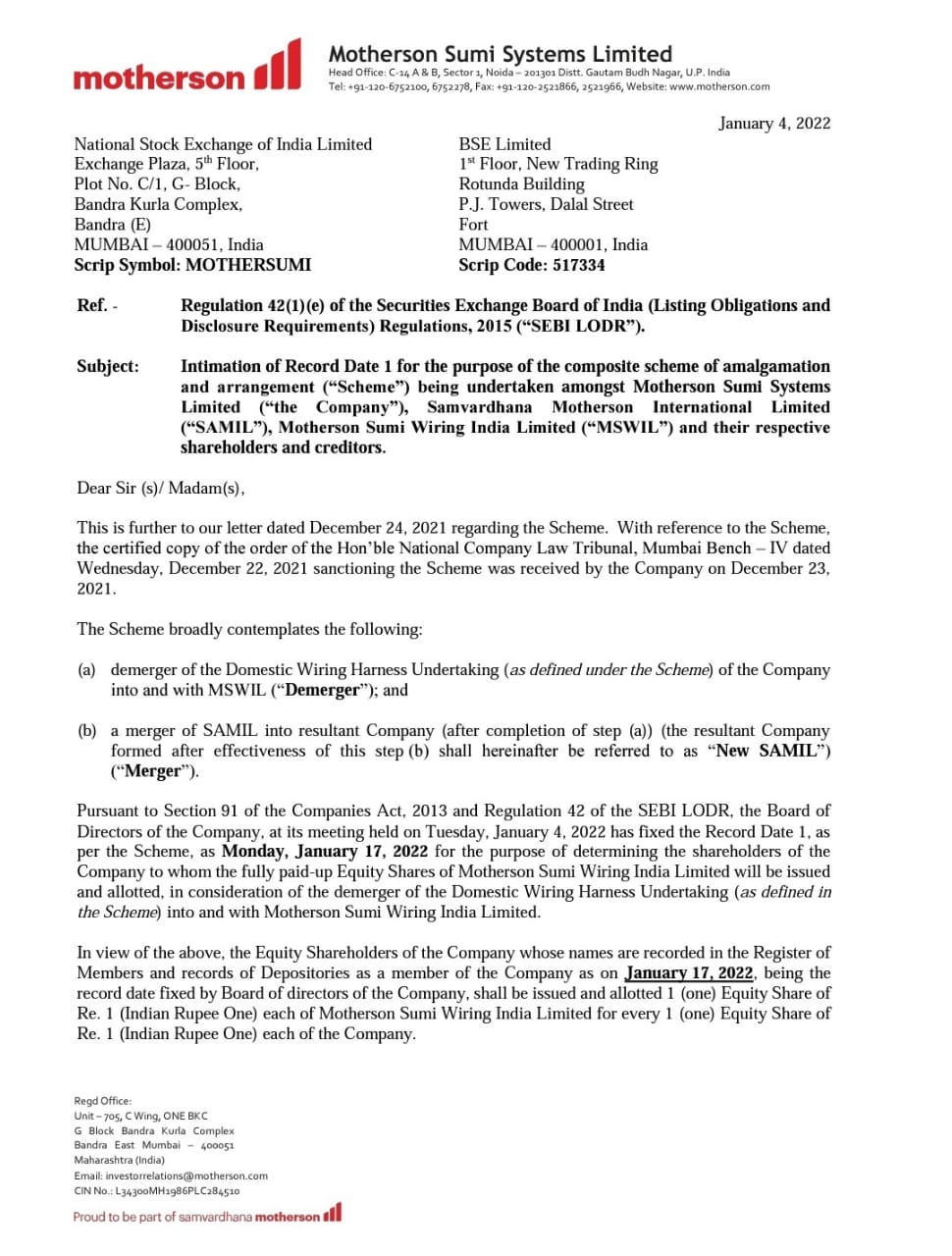

1) Record date for Motherson Sumi demerger is 17th Jan 2022. (Above image)

2) Demerger of GMR Infra( GMR Infra is demerging its non - airport business of the company , record date : 12th Jan 2022)

Thats all for today folks, Stay tuned for next issue .

If you liked this issue consider like and share this with your friends and family.

Disclaimer : The contents of this post should not be considered as investment advice,this is for educational purpose only. Please consult your investment advisor before acting. 'I’m not SEBI registered advisor .